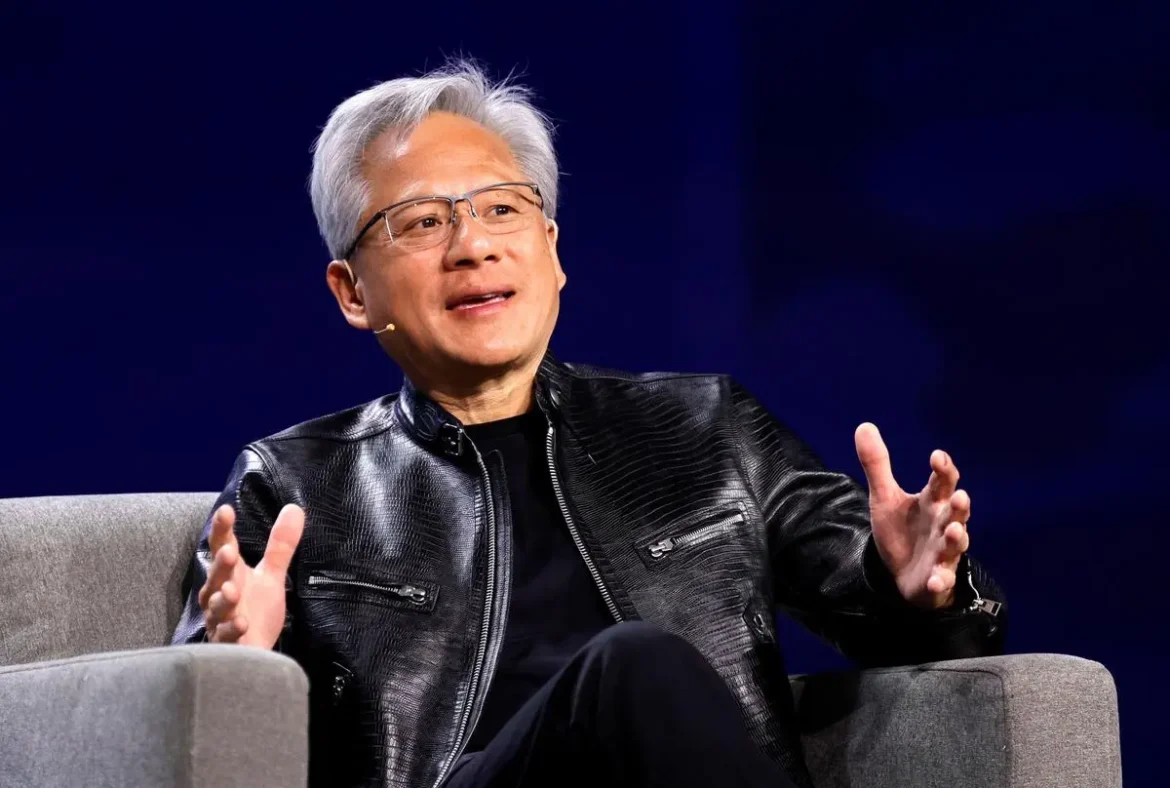

Nvidia CEO Jensen Huang has said that the clearest signal of China’s approval to purchase Nvidia’s advanced H200 artificial intelligence chips will not come through an official declaration or public announcement, but through actual purchase orders from Chinese customers.

Speaking on the sidelines of the Consumer Electronics Show (CES) 2026 in Las Vegas, Huang explained that regulatory clearances in China are unlikely to be communicated formally. Instead, he said, market activity itself will reveal whether approvals have been granted.

“We’re not expecting any press releases or large declarations,” Huang said. “If the purchase orders come, it means they’re able to place purchase orders.”

Licensing Process Still Underway

Earlier on Tuesday, Nvidia Chief Financial Officer Colette Kress told analysts that the U.S. government is working intensively on export license applications that would allow Nvidia to ship its H200 chips to China. While the Biden administration had previously imposed strict restrictions on advanced AI chip exports, recent policy adjustments have reopened limited pathways for sales — subject to licensing.

However, Nvidia has not yet received confirmation on when approvals will be finalized. Kress said the process remains active but did not provide a timeline.

Why the H200 Matters

The H200 chip, part of Nvidia’s Hopper architecture, is designed for high-performance AI workloads, including large language models, data center acceleration, and advanced machine learning applications. It sits just below Nvidia’s latest Blackwell platform, which the company unveiled as its next major leap in AI computing.

China represents one of the world’s largest markets for AI infrastructure, and analysts estimate that access to Chinese demand could translate into billions of dollars in additional revenue for Nvidia.

Huang noted that demand from China is already strong, even before formal approvals are issued. Nvidia has reportedly ramped up supply chain readiness to respond quickly if orders begin to flow.

Geopolitics Meets Market Reality

The situation highlights how geopolitical controls are increasingly shaping global semiconductor trade, often in quiet and indirect ways. Rather than formal approvals, companies and investors are watching for tangible indicators — such as shipping activity and order books — to assess real market access.

Industry analysts say that this “silent approval” approach allows regulators to maintain flexibility while avoiding public political signaling, especially in sensitive technology sectors like AI.

Interesting Read

Nvidia’s Bigger Growth Strategy

At CES 2026, Nvidia also showcased its future Vera Rubin computing platform, underscoring its long-term strategy to dominate AI infrastructure globally. The company has set aggressive growth targets, with leadership projecting hundreds of billions of dollars in combined system sales from its current and next-generation platforms over the next few years.

China, if fully reopened as a market, could play a crucial role in achieving those goals.

What to Watch Next

For now, Nvidia investors, competitors, and policymakers will be closely watching one key indicator:

the arrival of purchase orders from China.

As Huang made clear, in today’s AI chip race, orders speak louder than announcements.